This article was originally published in the January edition of The Journal Entry, published by the Utah Association of CPAs.

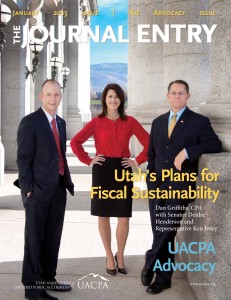

By Dan Griffiths, CPA

Leadership means having the courage to say the hard things that people need to hear. Ernie Almonte, a past chair of the AICPA taught me this lesson and it is something I have experienced personally over the past several months.

It Starts with a Conversation

When I participated in the 2010 AICPA Leadership Academy, we were asked to spend time discussing high-leverage opportunities for the CPA profession. Among others, we suggested that we are uniquely positioned to take a leadership role on the issue of government fiscal responsibility because CPAs have the public’s trust in financial matters. I distinctly remember senior AICPA leadership speaking up when this idea was discussed. They described how difficult it would be for the Institute to take a position on the issue because it was so politically sensitive.

Fast forward to May of this year. At its 125th anniversary celebration in Washington D.C., the AICPA unveiled a report, “What’s at Stake? A CPA’s Insights into the Federal Government’s Finances,” in which the AICPA came out in support of David Walker’s Comeback America Initiative making a strong case for fiscal responsibility.

When I returned home, I took the report to my local chamber of commerce in West Jordan and shared it with a few state legislators. The West Jordan Chamber of Commerce has now drafted a position paper, referencing the report and calling on local, state, and national leaders to take action. They have shared the paper with several other chambers and received strong support. Leaders with the Utah Association of CPAs met with state legislators this summer to discuss a public awareness campaign and prepare legislation at the state level to address issues of fiscal sustainability.

Similar discussions are taking place around the country. All of this was possible because the CPA profession had the courage to say some of the hard things that we all need to hear. In doing so, we inspired others to act.

Let’s Get Prepared

Our meetings in the summer and fall led to the creation of Financial Ready Utah, a non-profit dedicated to educating citizens, business, and government of the need for financial preparedness. We will be working together with the Be Ready Utah campaign established to promote emergency preparedness.

Representative Ken Ivory of West Jordan frames up the issue as follows:

“In Utah, we pride ourselves on our fiscal responsibility. We balance our budget. The painful truth is 40% of our state spending comes from a federal government that borrows 40 cents of every dollar it spends. As a business, if 40% of your revenue was derived from a single unsustainable source, wouldn’t you want to develop some contingency plans to prepare for declines in that revenue?

“Everyone knows that federal finances are a mess. The numbers are truly mind-boggling. An important footnote that the CPA community will understand is the fact that the federal government reports current year spending on a cash basis. It fails to incorporate the year-over-year growth in unfunded obligations for everything from Social Security and Medicare to Veteran’s benefits. If the federal government were to report its financial results the same way that U.S. corporations are required to report their results, estimates put the annual deficit as high as five trillion dollars. That’s more than $40,000 per household in a single year! Without a change of course, we will be facing a lot of broken promises.”

Senator Deidre Henderson was recently elected to the Utah State Senate. About five years ago, she decided to get involved in the political process as the campaign manager for Jason Chaffetz. “When I saw federal deficits hit 500 billion dollars, that’s when I felt compelled to get involved. With six trillion dollars in accumulated debt since then, what I wouldn’t give to see annual deficits of only half a trillion dollars.”

In 2011, we watched the debacle of the debt ceiling debate and the failure of the so-called Super Committee to reach any consensus. The fiscal cliff fiasco, being played out in Congress as this article goes to print, makes it clear that the answers to these challenges are not to be found in Washington. If we want things to change, we’ll need to start here in our state.

Watch for New State Legislation

In 2011, Representative Ivory crafted and passed a bill requiring state agencies to report federal receipts and to begin to develop contingency plans should those funds decrease in any way. In the wake of the credit downgrade of the United States, Ivory relates “when Moody’s began reviewing all states for corresponding ratings downgrades, this bill was a major factor in not even reviewing Utah’s credit rating for downgrade as we were the only state making such preparations for the unfortunate prospect of diminishing federal funds. Utah is leading the nation on this issue.”

Senator Henderson and Representative Ivory are sponsoring a package of bills during the upcoming legislative session that takes this preparation to a whole new level. The legislation contemplates the creation of a task force to review the immediacy, severity and probability of risks to Utah’s fiscal sustainability and to implement broad planning and budget measures to address such risks. The task force would be composed of legislators and leaders in business (including the CPA profession), the community, and municipal government.

They will be charged with identifying key risks we currently face and how to prepare for them. In order to address unprecedented, looming fiscal issues, we need to think differently. There will need to be changes in the way that we plan and budget. Senator Henderson indicates that, “as I meet with legislators from other states, it’s clear that Utah is leading. I recently attended a conference where nearly every session mentioned what Utah is doing. Other states are looking to Utah as a model for confronting issues of fiscal responsibility.”

What Can You Do?

You understand numbers. You know that government deficits are being reported on a cash basis and do not reflect the astounding growth in unfunded obligations for things like Social Security and Medicare. You know how the story ends. You have seen what too much debt can do to a business or household. Most of all, people trust you to be objective and balanced.

Share the message. This is not about politics; it’s about the unfortunate math! Talk to family, friends and neighbors. Help them understand the scope of the math problem and most importantly, the urgency in addressing it. Write an op-ed for the local paper. Give some encouragement to your state legislators and to the governor. There are no easy answers and it will take courage to act. Help them see the upside in preparing now for the financial “earthquakes” on the horizon.

Get Involved. Join with the UACPA in the Financial Ready Utah campaign. Your city, county or school district probably has a budget committee, volunteer. Your insights as a CPA will be invaluable. Our municipal governments will face enormous fiscal strain as the federal government is forced to deleverage in some form. We will need CPAs to pitch in and help with those challenges. To quote Margaret Mead, “Never doubt that a small group of thoughtful committed citizens can change the world. It is the only thing that ever has.”

Speak up, People Will Listen

We might be tempted to ask, “What difference could I possibly make? I’m just one voice. I’m just a numbers guy or gal.” In today’s hyper-connected world, one voice can make more of a difference than you may think, especially when that voice is joined by others who are willing to speak the truth in an independent, credible manner.

In the continued wake of the London InterBank Offered Rate (LIBOR) scandal, trust in corporate, financial, and government institutions are at historic lows. This dearth of integrity, whether perceived or real, creates an opportunity for CPAs. Research by the Gallup Organization indicates that people choose to follow others for these four reasons: trust, compassion, stability, and hope. People are hungry for leaders willing to tell the truth. As CPAs, we can leverage our integrity to foster trust and stability. As leaders, we confront the unvarnished truth, but refuse to complacently accept things as they are. We focus, instead, on the possibilities of what could be and cultivate hope.

I am proud to be part of a profession that is willing to lead. With the accelerating pace of change, now more than ever, we need leaders who can create a sense of stability and inspire in others a feeling of trust and hope. Are we up to the challenge? Individually and collectively, are we prepared to say the hard things people need to hear? As a state, are we willing to confront the fact that 40% of our spending comes from an unsustainable source? Are we prepared to do what it takes to ensure that the future we leave to our children will be better than the one we inherited from our parents? Will we have the courage to stand up and speak the truth even when it’s uncomfortable?

I, for one, believe that we will. Future generations of CPAs are counting on us.